capital gains tax rate 2021

2021 Capital Gains Tax Rates. Long-term capital gains are gains on assets you hold for more than one year.

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

18 and 28 tax rates for.

. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. Add this to your taxable income. Capital Gain Tax Rates.

Whats new for 2021. Long-term capital gains are taxed at only three rates. The following are some of the specific exclusions.

Rate of CGT. Weve got all the 2021 and 2022 capital gains. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

40 for gains from foreign life policies and foreign. Tax rate based on income. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

First deduct the Capital Gains tax-free allowance from your taxable gain. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income. The Capital Gains Tax Return BIR Form No.

The federal government assesses capital gains taxes at the following rates. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from. The tax rate on most net capital gain is no higher than 15 for most individuals.

Events that trigger a disposal include a sale donation exchange loss death and emigration. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. The following Capital Gains Tax rates apply.

Theyre taxed at lower rates than short-term capital gains. Depending on your regular income tax bracket your. Some or all net capital gain may be taxed at 0 if your taxable income is.

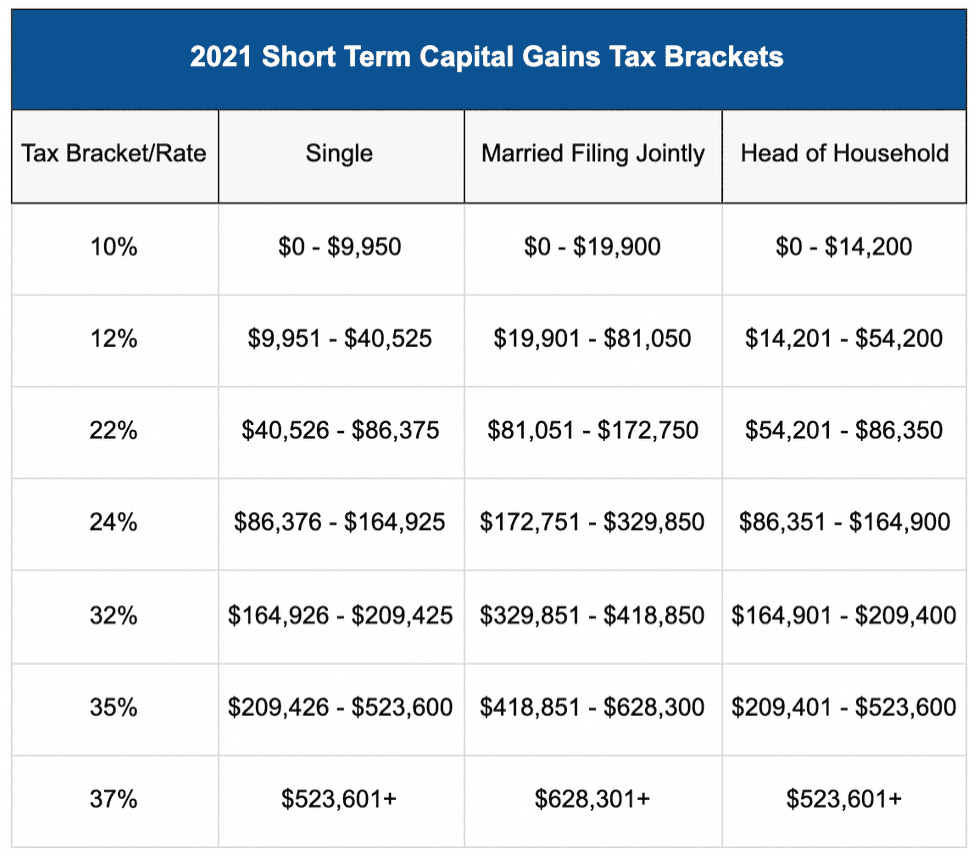

2021 Short-term capital gains tax rates. How the 0 Rate Works. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018 2016 to 2017 2015 to 2016.

To compare how the thresholds changed from 2020 to 2021 here are the figures for. The income thresholds for the capital gains tax rates are adjusted each year for inflation. The rate of CGT is 33 for most gains.

Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption. In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single. 0 15 and 20.

However it was struck down in March 2022. There are other rates for specific types of gains.

Capital Gains Tax Archives Skloff Financial Group

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax 2021 And 2022 Rates Personal Capital

What You Need To Know About Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

How Are Capital Gains Taxed Tax Policy Center

State Taxes On Capital Gains Center On Budget And Policy Priorities

Crypto Capital Gains And Tax Rates 2022

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Definition Taxedu Tax Foundation

Capital Gains Tax In The United States Wikipedia

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)